Year End Sale 50% off

Portfolio Analysis Tool

The Portfolio Analysis tool provides investors with insights into the performance of their holdings, dividends declared, and access to research reports for individual stocks. Additionally, within the Research Report section, investors can access the latest brokerage recommendations tailored to their portfolio holdings.

Demo Portfolio

No Data

No Data

Holdings - 0

View all Trade Records

No Stocks

Best Performers

Worst Performers

Segment Analysis

Size Analysis

Key Portfolio Metrics

Dividends

Table View

Dividend Yield : %

Estimated Dividends : ₹

Fundamentals

Performance Tracker

Research Report

Corporate Action

No Data Available

News

About Portfolio Analysis

What is Portfolio Analysis?

Portfolio Analysis tool allows investors to check the performance of their portfolio at regular intervals. Portfolio Analysis tool offers a complete overview of the stocks held by the investor, including the name of each stock, the quantity of shares owned, the percentage of the portfolio each holding represents, as well as the profit or loss percentage associated with each stock. Additionally, it may provide various other metrics and insights to help investors make informed decisions about their investment strategy.

Benefits of Portfolio Analysis -

• Risk Assessment : Portfolio analysis helps you assess and understand the risk exposure of your investments. This enables you to make more informed investment decisions aligned with your risk tolerance.

• Performance Evaluation : Portfolio analysis tool allows you to evaluate the performance of your investments.

• Decision-making Support : Portfolio analysis provides valuable insights and data-driven information to support your informed decision-making process.

• Goal Alignment : Conducting portfolio analysis helps align your investments with your financial goals. Regularly reviewing your portfolio's performance and progress ensures that your investment strategy remains consistent with your objectives. Monitoring your portfolio allows you to make necessary adjustments, such as rebalancing or realigning asset allocations, to stay on track toward achieving your long-term goals.

Features of Portfolio Analysis tool

• Holdings- The holdings section of Portfolio Analysis tool allows you to view a detailed breakdown of your holdings including the current market price of the shares that you hold, quantity of shares held by you, average price of each stock, percentage of each stock that you are holding, total value of your stocks and also know the profit/loss percentage of your stocks for detailed analysis.

• Heatmaps- You can visualize the performance of your stock holdings through heatmaps of the Portfolio analysis tool that provides a rapid overview of the day's best and worst performing stocks in your portfolio.

• Top Best and Worst Performers- The Portfolio Analysis tool allows investors to identify the top-performing and worst performing stocks that you have in your portfolio

• Sector Analysis and Industry Analysis- Utilizing the sector analysis and industry analysis features of the Portfolio Analysis tool, you can assess the sectors and industries in which your stocks are held. This provides a clear perspective on the diversification of your portfolio.

• Dividends Payers List- Using the dividends payers list, you can determine the estimated dividends you will receive from the stocks held in your portfolio.

• Fundamentals- Fundamentals of Portfolio Analysis tool allows you to check the fundamentals of the stocks that you hold by dis different metrices such as PE, ROE, ROCE, current ratio and many more.

• Smart Score- The Portfolio Analysis Tool's Smart Score evaluates a company on a scale of 1 to 5 across various metrices such as value, growth, profit, quality, performance, and ownership.

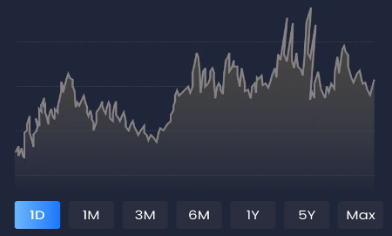

• Performance tracker- You can monitor the quarterly performance of the stocks within your portfolio by utilizing the performance tracker feature of the portfolio analysis tool. This tracker measures quarterly performance based on metrics such as net sales, net profit, and profit margin.

• Research Reports- The research reports generated by the Portfolio Analysis tool offers brokerage recommendations regarding whether to buy, sell, or hold the stocks currently held within your portfolio.

FAQs

How to Evaluate Your Portfolio?

Ans- Analyzing your portfolio entails several steps aimed at gauging its performance in accordance with your investment objectives. Utilizing the Portfolio Analysis tool provided by Trade Brains Portal can streamline this process.

Steps:

• Portfolio Creation: Begin by setting up your portfolio.

• Stock Addition: Add stocks to your portfolio.

• Diversification: Ensure diversification by including stocks from various sectors.

• Holdings Analysis: Assess the performance of your holdings.

• Rebalancing: Adjust your portfolio as needed to maintain desired allocations.

How do I know if my portfolio is good or bad?

Ans- Determining whether your portfolio is good or bad depends whether it aligns with your financial goals. Your portfolio should be well-diversified across various sectors and industry. Diversification helps spread risk and can indicate a well-constructed portfolio. Continuously monitor and review your portfolio's performance and make adjustments as necessary.

How many stocks should be in portfolio?

Ans- The number of stocks in a portfolio can vary based on individual preferences, investment goals, risk tolerance, and portfolio diversification strategies.

Is portfolio analysis only for professional investors?

Ans- No, portfolio analysis is for everyone in the market. It helps you analyse the state of your portfolio as per the current market situation.

Can portfolio analysis help in managing risks?

Ans- Yes, portfolio analysis can indicate the risk of your portfolio. It gives an overview of how the stocks in your portfolio are performing.